All Categories

Featured

Table of Contents

- – How do I get started with an Guaranteed Return...

- – What is the difference between an Annuity Inve...

- – What should I look for in an Long-term Care A...

- – What is the difference between an Retirement ...

- – Where can I buy affordable Senior Annuities?

- – Who offers flexible Annuity Investment polic...

Keep in mind, however, that this doesn't state anything about changing for rising cost of living. On the bonus side, also if you think your alternative would be to buy the supply market for those seven years, which you 'd get a 10 percent annual return (which is far from particular, particularly in the coming years), this $8208 a year would be more than 4 percent of the resulting small supply worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with four settlement options. Politeness Charles Schwab. The monthly payout here is highest possible for the "joint-life-only" choice, at $1258 (164 percent more than with the prompt annuity). Nevertheless, the "joint-life-with-cash-refund" option pays just $7/month much less, and guarantees a minimum of $100,000 will certainly be paid out.

The way you buy the annuity will identify the response to that question. If you get an annuity with pre-tax bucks, your premium minimizes your taxed income for that year. According to , purchasing an annuity inside a Roth plan results in tax-free repayments.

How do I get started with an Guaranteed Return Annuities?

The consultant's very first step was to establish a comprehensive economic strategy for you, and afterwards clarify (a) exactly how the suggested annuity fits right into your overall strategy, (b) what alternatives s/he considered, and (c) exactly how such options would or would not have actually caused lower or greater settlement for the advisor, and (d) why the annuity is the remarkable choice for you. - Annuity withdrawal options

Obviously, an expert may attempt pushing annuities also if they're not the best fit for your circumstance and goals. The factor can be as benign as it is the only item they offer, so they fall target to the typical, "If all you have in your toolbox is a hammer, rather quickly everything begins resembling a nail." While the advisor in this situation might not be unethical, it raises the risk that an annuity is a poor choice for you.

What is the difference between an Annuity Investment and other retirement accounts?

Because annuities typically pay the agent offering them a lot higher compensations than what s/he would certainly receive for spending your cash in mutual funds - Secure annuities, not to mention the zero commissions s/he would certainly receive if you spend in no-load mutual funds, there is a large motivation for agents to press annuities, and the more complicated the far better ()

An unethical expert recommends rolling that quantity right into brand-new "better" funds that simply take place to bring a 4 percent sales tons. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't most likely to do far better (unless you chose a lot more inadequately to start with). In the exact same instance, the expert can guide you to purchase a complex annuity with that said $500,000, one that pays him or her an 8 percent compensation.

The consultant attempts to rush your choice, asserting the deal will quickly vanish. It may indeed, yet there will likely be equivalent deals later. The consultant hasn't figured out how annuity repayments will certainly be taxed. The expert hasn't revealed his/her settlement and/or the costs you'll be charged and/or hasn't revealed you the effect of those on your eventual settlements, and/or the compensation and/or fees are unacceptably high.

Existing passion prices, and therefore projected settlements, are traditionally low. Even if an annuity is best for you, do your due persistance in comparing annuities marketed by brokers vs. no-load ones marketed by the issuing business.

What should I look for in an Long-term Care Annuities plan?

The stream of month-to-month payments from Social Safety and security is comparable to those of a delayed annuity. Given that annuities are voluntary, the people acquiring them typically self-select as having a longer-than-average life expectancy.

Social Safety benefits are completely indexed to the CPI, while annuities either have no rising cost of living security or at a lot of offer a set portion yearly boost that might or might not make up for rising cost of living completely. This kind of cyclist, similar to anything else that boosts the insurer's threat, requires you to pay even more for the annuity, or approve lower payments.

What is the difference between an Retirement Annuities and other retirement accounts?

Disclaimer: This article is intended for educational functions just, and must not be thought about economic suggestions. You should consult an economic professional prior to making any type of major economic decisions. My profession has had many unpredictable weave. A MSc in academic physics, PhD in experimental high-energy physics, postdoc in bit detector R&D, research position in speculative cosmic-ray physics (including a number of sees to Antarctica), a short job at a tiny design services business sustaining NASA, adhered to by beginning my very own tiny consulting method sustaining NASA projects and programs.

Given that annuities are meant for retired life, tax obligations and penalties may apply. Principal Protection of Fixed Annuities.

Immediate annuities. Made use of by those who desire trusted income right away (or within one year of acquisition). With it, you can customize income to fit your demands and develop revenue that lasts forever. Deferred annuities: For those who desire to grow their money in time, yet want to defer access to the cash up until retired life years.

Where can I buy affordable Senior Annuities?

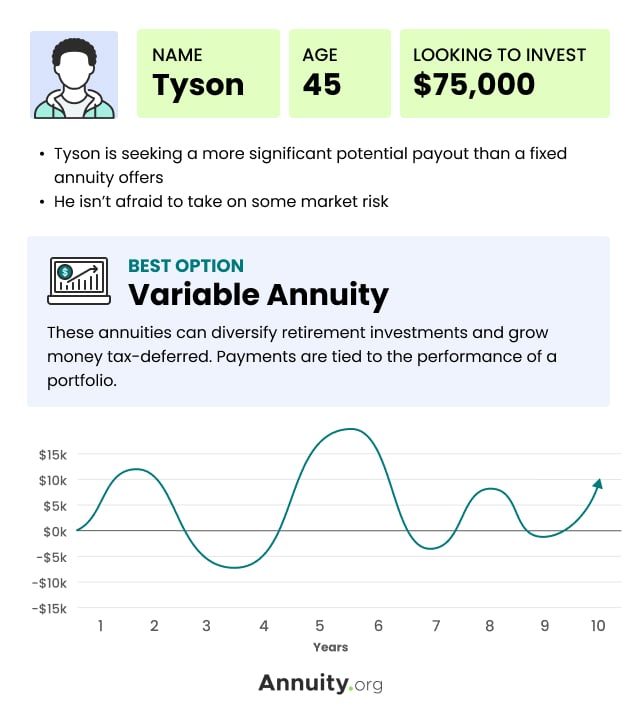

Variable annuities: Offers higher capacity for development by investing your cash in investment options you select and the capability to rebalance your profile based on your choices and in a means that straightens with changing economic objectives. With dealt with annuities, the firm invests the funds and gives a rate of interest rate to the client.

When a fatality claim accompanies an annuity, it is essential to have actually a named recipient in the contract. Different choices exist for annuity death advantages, depending on the contract and insurance provider. Picking a reimbursement or "period particular" option in your annuity gives a death benefit if you die early.

Who offers flexible Annuity Investment policies?

Calling a recipient other than the estate can aid this procedure go extra efficiently, and can aid make certain that the profits go to whoever the private wanted the cash to go to rather than going via probate. When present, a death advantage is automatically included with your contract.

Table of Contents

- – How do I get started with an Guaranteed Return...

- – What is the difference between an Annuity Inve...

- – What should I look for in an Long-term Care A...

- – What is the difference between an Retirement ...

- – Where can I buy affordable Senior Annuities?

- – Who offers flexible Annuity Investment polic...

Latest Posts

Analyzing Annuities Variable Vs Fixed A Comprehensive Guide to Variable Vs Fixed Annuity What Is the Best Retirement Option? Pros and Cons of Fixed Annuity Vs Equity-linked Variable Annuity Why What I

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Advantages and Disadvantages of Immediate Fixed Annuity Vs Vari

Exploring Tax Benefits Of Fixed Vs Variable Annuities A Comprehensive Guide to Fixed Annuity Vs Equity-linked Variable Annuity Breaking Down the Basics of Investment Plans Benefits of Choosing the Rig

More

Latest Posts